Questions? Call or Text

(484) 626-1616

You’ve probably heard that now’s the time for buyers to get into the market. The main reason for this is interest rates - that is, historically low interest rates, and the probability that they will rise in 2020.

If you’re considering buying a home in the next year, you may want to bump up that timeline. Right now, interest rates are low enough that you could afford more home than ever before. We’re talking about how interest rates affect your buying power and why you can afford to buy more home for less by taking advantage of today’s rates.

How Interest Rates Affect Buyer’s Purchasing Power

It’s important to understand how interest rates affect how much home you can afford. After all, the interest rate you can secure will impact not just monthly house payments, but also your overall purchasing power.

What is your purchasing power? It refers to how far your dollar goes. Purchasing power is the amount of house you can afford based on your available budget. There are all sorts of factors that go into this, like your down payment amount, debt, and credit score.

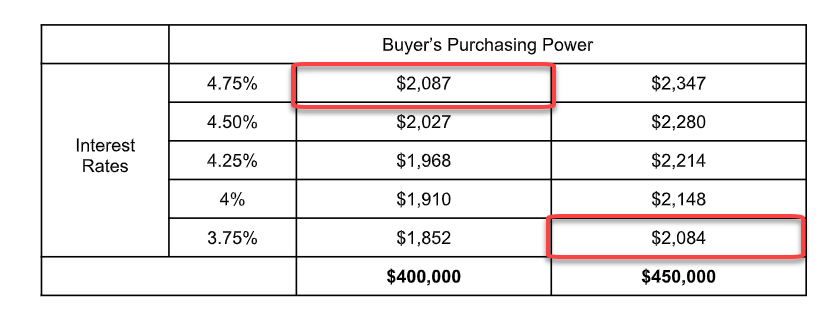

But interest rates play a huge role in what kind of home you can buy. Take a look at the chart below, which shows how different rates affect monthly payments for two different houses.

The chart above doesn’t factor in any down payment amount on the home and focuses on Principal and Interest (P&I) monthly payments. If you’re interested to see how your monthly payment may change with these interest rates, you can calculate that here.

Paying Less for More Home

You can see how the buyer’s purchasing power changes based on what interest rate they can secure. We’re specifically looking at homes in the $400,000 and the $450,000 range.

A buyer who secures a rate of 3.75% for their new home could have the same monthly payment ($2,087) on a $450,000 home as someone with a rate of 4.75% would spend on a $400,000 home. The lower the interest rate you can get, the more home you can afford.

Today’s buyers can afford more home for the same monthly payments. You can extend these numbers to larger, more expensive homes depending on your budget.

Comparing Today’s Rates to The Past

Today’s interest rates are historically low. Even just a few years ago, rates were double if not triple what they are now. Back in 2006, the average mortgage interest rate was 6.4%. While that’s not terribly higher than today’s higher rates, even a few percentage points can make a huge difference in monthly payments.

Before that, in 2000, interest rates were averaging at 8%. Your monthly payments for a $400,000 home back then would have been $2,935 -- nearly double the highest amount on the chart above.

While doubled interest rates may not seem crazy to you, consider what homebuyers faced back in the ’80s. In 1981, buyers faced interest rates at 16% or higher (source).

Can you even imagine? Compare that to today’s rates, even on the high end of 4.75%, and you can see why so many people are urging homebuyers to jump into the market right now.

Home Buyers Today Can Afford More Home for Less

The interest rate you secure plays a considerable role in determining how much home you can afford. Today’s rates are crazy low compared to those just a few years ago, not to mention those back in the ’80s and ’90s.

If you’re looking to buy a home, now’s the time to do it. You can take advantage of these historically low interest rates. You can even go beyond your expected price range because you can realistically secure a rate low enough to pay the same monthly payments on a bigger, more expensive home.

The market is hot right now for a good reason. Lower interest rates help home buyers - whether first-time buyers or seasoned buyers looking for their next home - get more bang for their buck.

Interested in scheduling an appointment to tour one of our communities? #AskMartha! Our team at Tuskes Homes can provide all of the necessary mortgage and construction information you need to build and move into your dream home! Call / Text 484-626-1616 or email marthac@tuskeshomes.com

Ken and Theresa were looking to downsize after they became empty nesters, and they were thrilled to find a ranch-style home that offered single floor living and a finished basement for additional space.

Hear Michelle & Aaron talk about their experiences building their "forever home" and how we helped them feel welcomed before they even moved in.

PJ and Tiffany were able to find the exact home they envisioned that checked every mark on their wish list when they decided to build with Tuskes Homes at our Maple Shade Estates Community.

The Swauger family chose Tuskes Homes and our Wolf's Run community to call home, where Lily finds her dream room- a space she had always imagined.

Send me a quick message and I'll get back with you shortly!